Finance Department > Taxes

Property Taxes

The Kitsap County Treasurer collects the property tax levied by the City of Poulsbo and remits it to the City on a monthly basis. The majority of these taxes are received in May and November for taxes payable to Kitsap County twice a year. The property tax is recorded in the City’s General Fund.

| 2023 – Property Taxes Paid On Home With An Assessed Value of $400,000 | ||

| Taxing Jurisdiction | Tax Rate | Tax Paid |

| Schools (State & Local) | 4.799354 | $1,919.74 |

| County | 0.651583 | $260.63 |

| Port | 0.182934 | $73.17 |

| City | 1.031093 | $412.44 |

| PUD | 0.044723 | $17.89 |

| Library (Regional) | 0.276157 | $110.46 |

| Fire District #18 & EMS Levy | 1.874247 | $749.70 |

| TOTAL | 8.860091 | $3,544.04 |

Sales Tax

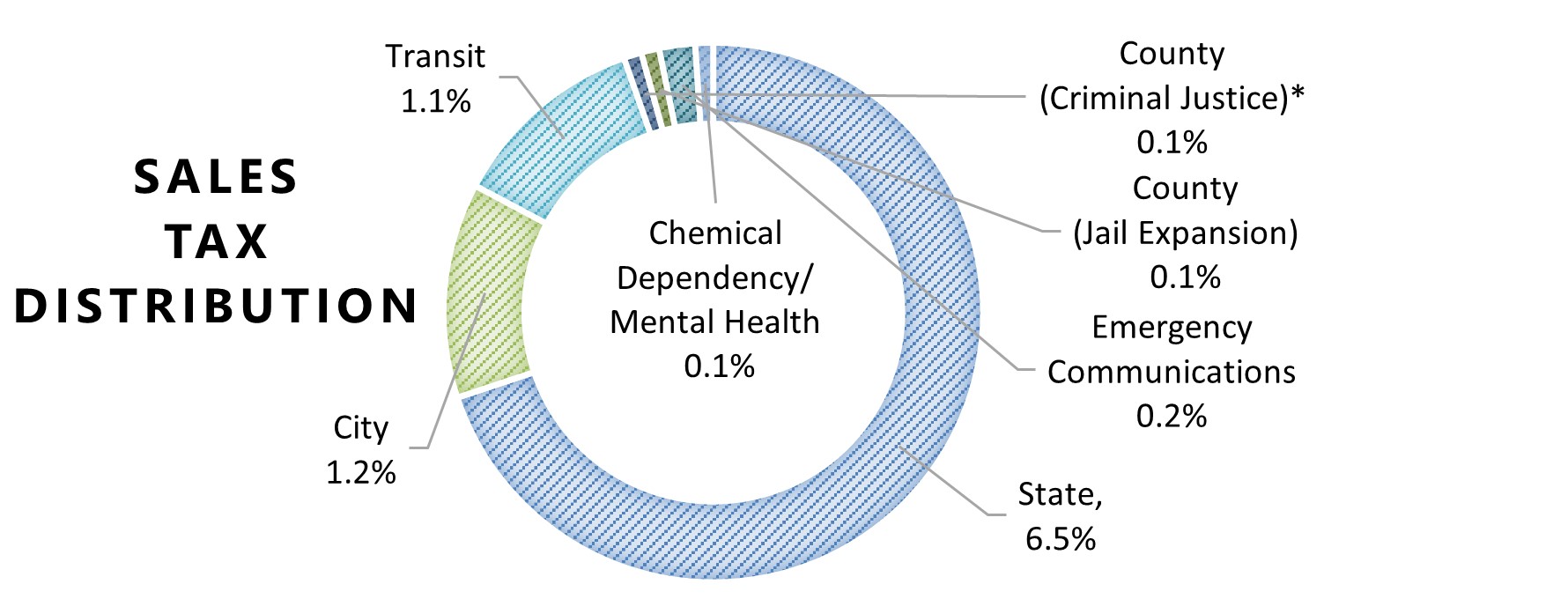

Effective April 1st, 2023 – sales and use tax within the City of Poulsbo increased one-tenth of one percent (.001), bringing the total sales tax rate to 9.3%. The tax will be used for transportation services.

The State of Washington collects the 9.3% sales tax paid to vendors doing business within Poulsbo city limits and will distribute the City’s portion (1.2%) back to the City on a monthly basis. 1% of the received sales tax is recorded in the City’s General Fund, the newly approved .1% will be recorded in the Transportation Benefit District fund, with the remaining .1% recorded in the Affordable Housing Fund.

Sales tax is the City’s largest revenue source and, although it is a healthy source of income for the City, the City has historically been very conservative in its estimation.

*The County keeps 10% of this revenue; the remaining 90% is distributed back to the cities located within the county, based on population.

Utility Tax

Utility Taxes are taxes applied to utilities providing services in the City of Poulsbo. These include city-owned and privately-owned utilities. These tax rates are reviewed annually.

Effective Utility Tax Rates:

- Water (12%)

- Sewer (12%)

- Solid Waste (6%)

- Storm Drain (12%)

- Electric (6%)

- Natural Gas (6%)

- Telephone (6%) – exclusive of Internet based services

- Cable Services (6%) – exclusive of Internet based services

Business & Occupation Tax

Effective July 1, 2024, the City of Poulsbo will implement a Business and Occupation (B&O) tax.

As an incorporated City, one way the City of Poulsbo will collect revenue to support operational expenditures is through the B&O tax, which will be levied on businesses operating within city limits. This gross receipts tax will apply to the gross revenue measured on the value of products, proceeds of sales, or gross income the business receives. Gross receipts tax means there will be no deductions for labor, materials, or other costs of doing business.

The City of Poulsbo B&O tax is not the same as the Washington state B&O tax and will need to be filed separately from your state taxes.

To learn more about the City’s B&O tax, exemption thresholds, deductions, implementation, and instructions on how to file please visit the B&O Tax page.

Other Taxes

The remaining taxes are composed of miscellaneous taxes that include: